The Fed's monetary policy prison

How Congress has left the central bank between a rock and a hard place

At the end of this month, the Federal Reserve will decide once again what to do about interest rates. Virtually everyone thinks it will cut. But while the expectation is nearly unanimous, it certainly isn't uncontroversial. Speaking for many mainstream analysts, Mohamed A. El-Erian, a former economic adviser to President Obama, pointed out that an interest rate cut will come with real trade-offs: It will leave the central bank less prepared for the next recession, or possibly exacerbate the next financial bubble.

That does not mean the Fed shouldn't cut. It does mean the Fed is stuck in a policy prison where it has very little room to maneuver, and where none of its options are great.

There are two reasons for this: The first is Congress' failure to act on fiscal policy. The legislative branch has become so hopelessly deadlocked by Republican indifference and obstruction that action in any situation short of a total emergency is a pipe dream. But beneath that failure is the whole way U.S. policymakers conceive of the divide between the "fiscal" and "monetary" tool kits at their disposal.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

As a refresher, fiscal policy is what Congress does: taxes and spending and public investment and all that. (It can also be what state legislatures do with those same tools.) Monetary policy is what the Federal Reserve does: buying and selling financial assets to adjust various interest rates and keep the overall financial system from seizing up. According to the conventional Washington wisdom of recent decades, fiscal policy's job is to provide various public needs, yes, but also to keep its own books balanced. Monetary policy's job is to balance the economy: To make sure job and wage growth is running as hot as possible, without tipping into "overheating" and an unsustainable rise in the inflation rate.

Unfortunately for the Fed, we've reached the tail end of a multi-decade experiment in this division and assignment of roles, only to discover it doesn't work.

For a start, the Fed's powers are asymmetric. It can hike interest rates — squashing job and wage growth — as much as it wants. But it can't cut interest rates — and thus boost job and wage growth — below zero. This leads to El-Erian’s first concern: The Fed has historically needed to cut interest rates by 4 or 5 percentage points to combat recessions. But it's currently setting them at 2.25 to 2.5 percent. That's already too low, and if the Fed starts cutting now, it will have even less room to maneuver when the next downturn comes.

Beyond that, the economy is a feedback loop between consumption and investment, and the Fed is only able to affect one side of that feedback loop. Think of interest rates as a wall between people who want credit and people who supply credit; the Fed lowers or raises that well depending on how hot it wants the economy to run. What the Fed can't do is create more demand for credit than is already there. If the hunger out in the economy for more credit and investment is already low, then it won't really matter how much the Fed lowers its wall. And if the wall is already torn down, there's nowhere left to go in the case of a recession.

That's basically the trap the Federal Reserve is in.

The tool that can create more demand for credit is fiscal policy. By pumping more money into people's pockets, either through welfare state spending or direct government hiring, the government injects more aggregate demand into the economy. That gives everyday people more ability to buy goods and services, which justifies business expansions and the credit-creation needed to fuel that investment.

Unfortunately, Congress has completely dropped the ball on this front. Its fiscal stimulus in the immediate aftermath of the Great Recession was far too small, and its done next to nothing since. The 2017 tax cut barely made a dent because nearly all its benefits went to the wealthiest, who do not need — and thus will not spend — the additional dollars. In fact, fiscal policy has arguably under-powered the economy ever since the end of the 1970s: With every recession since, the Fed has cut interest rates lower, without ever being able to return them to their previous high. With the Great Recession, the central bank's interest rate target finally bottomed out at zero.

Fiscal policy can also work the other way. When inflation spiked at the beginning of the 1980s, Congress could have raised taxes or tried other regulatory efforts to slow down prices while putting most of the burden on the wealthy. Instead, we went the monetary policy route and the Fed chairman at the time, Paul Volcker, massively hiked interest rates, destroying millions of jobs and incomes in the process and setting the country on a path toward runaway inequality. Once the downward spiral set in, only fiscal stimulus could reverse it.

This ties into another one of El-Erian's concerns today: That economic fundamentals — like business investment and wage growth — remain mediocre, despite the recovery, while stock and financial markets continue to boom — with all their attendant risks of bubbles and busts. Frankly, policymakers shouldn't rely on interest rates to contain financial bubbles in the first place. That's a job much better suited to regulatory oversight. But if you want higher interest rates — either to ward off irrational exuberance in the financial markets or prepare for the next recession — you need economic fundamentals that are strong enough to support high interest rates. And that means more aggressive fiscal stimulus.

Now, the Fed might be able to escape this trap if it was willing to get really creative.

At a recent hearing, Rep. Rashida Tlaib (D-Mich.) asked Fed Chairman Jerome Powell why the central bank couldn't have backstopped short-term borrowing by state governments the same way it backstopped short-term borrowing by corporations in the aftermath of 2008. That would've allowed states to keep borrowing and spending, and thus boost the recovery, rather than cutting their budgets and thus worsening the downturn.

Powell claimed the Fed doesn't have the legal authority, which is wrong. A more honest answer is that backstopping borrowing by government actors, as opposed to private ones, comes too close to breaching the fiscal-monetary policy divide for comfort. For now, the central bank remains too institutionally cautious to go there.

Thus, the Fed is stuck. Yes, an interest rate cut might signal undo subservience to both President Trump and Wall Street investors. But ultimately the Fed answers to neither. Its obligation is to its legal charter, which obligates it to prioritize job growth as much as price stability.

All it can do is cut rates now, and pray the economy recovers enough to justify higher rates before the next recession. The rest is up to Congress.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

The hunt for Planet Nine

The hunt for Planet NineUnder The Radar Researchers seeking the elusive Earth-like planet beyond Neptune are narrowing down their search

By Chas Newkey-Burden, The Week UK Published

-

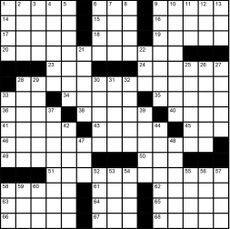

Magazine interactive crossword - April 26, 2024

Magazine interactive crossword - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine solutions - April 26, 2024

Magazine solutions - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Arizona court reinstates 1864 abortion ban

Arizona court reinstates 1864 abortion banSpeed Read The law makes all abortions illegal in the state except to save the mother's life

By Rafi Schwartz, The Week US Published

-

Trump, billions richer, is selling Bibles

Trump, billions richer, is selling BiblesSpeed Read The former president is hawking a $60 "God Bless the USA Bible"

By Peter Weber, The Week US Published

-

The debate about Biden's age and mental fitness

The debate about Biden's age and mental fitnessIn Depth Some critics argue Biden is too old to run again. Does the argument have merit?

By Grayson Quay Published

-

How would a second Trump presidency affect Britain?

How would a second Trump presidency affect Britain?Today's Big Question Re-election of Republican frontrunner could threaten UK security, warns former head of secret service

By Harriet Marsden, The Week UK Published

-

'Rwanda plan is less a deterrent and more a bluff'

'Rwanda plan is less a deterrent and more a bluff'Instant Opinion Opinion, comment and editorials of the day

By The Week UK Published

-

Henry Kissinger dies aged 100: a complicated legacy?

Henry Kissinger dies aged 100: a complicated legacy?Talking Point Top US diplomat and Nobel Peace Prize winner remembered as both foreign policy genius and war criminal

By Harriet Marsden, The Week UK Last updated

-

Trump’s rhetoric: a shift to 'straight-up Nazi talk'

Trump’s rhetoric: a shift to 'straight-up Nazi talk'Why everyone's talking about Would-be president's sinister language is backed by an incendiary policy agenda, say commentators

By The Week UK Published

-

More covfefe: is the world ready for a second Donald Trump presidency?

More covfefe: is the world ready for a second Donald Trump presidency?Today's Big Question Republican's re-election would be a 'nightmare' scenario for Europe, Ukraine and the West

By Sorcha Bradley, The Week UK Published